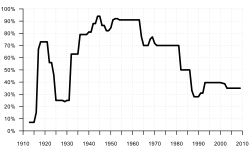

Top U.S. Federal marginal income tax rates.

Given the challenging economic climate, more businesses are incurring accounting losses. A concern for some owners is whether they are permitted to offset losses with other sources of income.

With regard to a member of a limited liability company (LLC), the general answer is yes, according to an article published by Crain’s Cleveland Business, written by Carl Grassi, president of law firm McDonald Hopkins LLC.

The author states “as a general rule, losses incurred by a business in which the taxpayer materially participates are deductible against other sources of income.”

To determine material participation, tax regulations provide seven tests, of which at least one must be met. One test requires that the participant devote more than 500 hours to the business in the year. Joe Kristan at accounting firm Roth & Company, PC provides a summary of the tests in everday language.Onward to becoming more tax efficient.